Which of the Following Statements Regarding Adjusting Entries Is True

Adjusting entries are optional with accrual basis accounting O c. 2 Adjusting entries may reduce amounts on the balance sheet and increase corresponding revenue or expense accounts on the income statement.

Acg2021 Ch 4 Concept Overview Videos Flashcards Quizlet

Adjusting entries are recorded to make sure all cash inflows and outflows are recorded in the current period.

. Which of the following statements regarding types of adjusting entries is true. Multiple Choice Adjusting entries are recorded after the closing entries have been recorded. Adjustments are only made if cash has been received or paid during the period.

Adjusting entries for revenues include a credit to cash. Adjusting journal entries do not affect the cash account. CAdjusting entries are not posted to the ledger.

Which of the following statements is true regarding adjusting entries. None of these statements are true. DNone of these statements are true.

Which of the following statements is true regarding adjusting entries. Which of the following statements regarding adjusting entries is false. Adjusting entries often affect the cash account D.

A Adjusting entries are made at the end of the accounting period. Equal totals in a trial balance guarantees that no errors were made in the recording process. Adjusting entries are done to post unrecorded business transactions.

O the accruing of interest expense o the payment of wages that have been accrued o the return of defective inventory O the payment of rent in advance O collection of an accounts receivable QUESTION 38 Which of the following statements regarding adjusting entries is true. O Adjusting entries are made at periodic. Adjustments help to ensure the related accounts on the balance sheet and income statement are up to date and complete.

None of these statements are true. YES After adjusting entries all temporary accounts should have a balance of zero. Adjustments are needed to ensure that the accounting system includes all the revenue and expenses of the period b.

Which of the following statements regarding the purpose of adjusting entries is are true. C Adjusting entries are required for accrual accounting. Which of the following statements is true.

Group of answer choices A. Adjustments are only made if cash has been received or paid during the period. Expensing prepaid insurance is an example of an adjusting entry.

The purpose of adjusting entries is to. Adjusting entries are needed because we use accrual-basis accounting. 3 Adjusting entries may be used to recognize revenue as earned and expenses when incurred prior to the receipt or.

Adjusting journal entries do not affect the cash account. Adjusting entries for expenses include a. 13Which of the following statements is true regarding adjusting entries.

After adjusting entries are made in the journal they are posted to the ledger. Adjusting entries always affect the cash account. Adjusting entries for expenses include a debit to cash.

Both A B are true d. Which of the following statements regarding the role of cash in adjusting entries is true. Adjustments help to ensure the related accounts on the balance sheet and income statement are complete c.

Adjusting entries affect profit or loss. Adjusting entries involve at least one balance sheet account and one income statement account. Adjusting entries are not posted to the ledger.

BAdjusting entries are optional with accrual basis accounting. Adjusting entries are recorded for all external transactions. Adjustments are needed to ensure that the accounting system includes all of the revenues and expenses of the period.

Adjustments are needed to ensure that the accounting system reflects all revenues and expenses that occurred during the period. 1 Adjusting entries nearly always involve the cash account and either a revenue or expense account. Adjusting entries should be dated as of the last day of the accounting period.

Adjustments are only made if cash has been received or paid during the period. A Adjust the owners capital account for the revenue expense and drawings recorded during the accounting period b Adjust daily the balances in asset liability revenue and expense accounts for the effects of business transactions. Adjusting entries arise from the internal operations of.

Adjusting entries are dated as of the first day of the new accounting period. AAdjusting entries are dated as of the first day of the new accounting period. Adjusting entries are not posted to the ledger O b.

Adjusting entries are dated as of the first day of the new accounting period. Which of the following statements regarding adjusting entries is not true. A deferral adjustment that decreases an asset will include an increase in an expense.

An explanation is normally included with each adjusting entry. Adjusting entries always include one balance sheet and one income statement account 23. In laymans terms to accrue means to accumulate while to defer means to postpone.

Adjusting entries are optional with accrual basis accounting. 14An adjusting entry debiting Unearned. Adjusting entries are done to correct errors made during the month.

D The recognition of depreciation expense is a deferral. Adjusting entries are typically recorded on the last day of the accounting period. An example of an adjusting entry is.

Which of the following statements regarding adjusting entries are not true. Debits are equal to. Which of the following statements regarding adjusting entries is not true.

Which of the following statements regarding the role of cash in adjusting entries is true. Which of the following statements regarding the role of cash in adjusting entries is true. B Adjusting entries can include cash transactions.

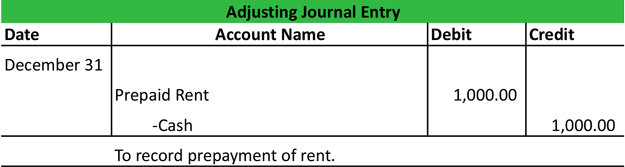

Adjusting Entries Types Example How To Record Explanation Guide

Answered Which Of The Following Is True About Adjusting Entries True Income Statement Balance Sheet

No comments for "Which of the Following Statements Regarding Adjusting Entries Is True"

Post a Comment